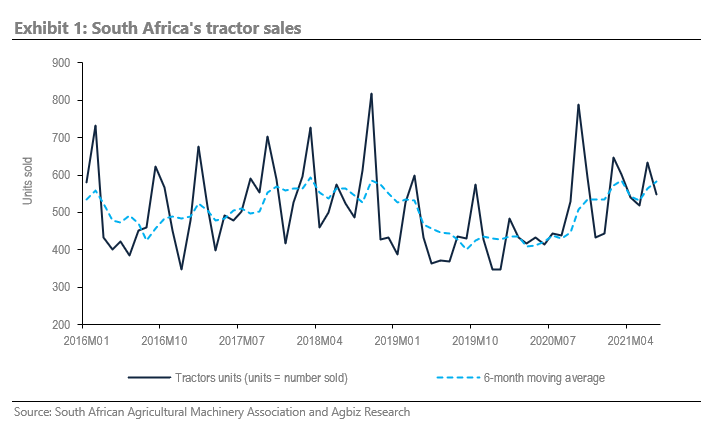

South Africa’s agricultural machinery sales remain strong as the 2021/22 production season approaches. In addition to the favourable weather outlook for the upcoming season and attractive grain prices, we view the strong sales as a positive indicator that farmers could plough a sizable area for summer grains and oilseeds of roughly four million hectares as the previous seasons. The recent data from the South African Agricultural Machinery Association show that tractor sales were up by 17% y/y in July, with 549 units sold.

South Africa’s agricultural machinery sales remain strong as the 2021/22 production season approaches. In addition to the favourable weather outlook for the upcoming season and attractive grain prices, we view the strong sales as a positive indicator that farmers could plough a sizable area for summer grains and oilseeds of roughly four million hectares as the previous seasons. The recent data from the South African Agricultural Machinery Association show that tractor sales were up by 17% y/y in July, with 549 units sold.

Again, considering the total tractor sales for the first seven months of this year, we are already 26% ahead of the corresponding period in 2020, with 3 934 units. However, it is worth noting that sales in much of last year were negatively affected by lockdown restrictions, so the base is slightly distorted. Still, 2020 was also a good year in South Africa’s tractor sales, so surpassing it means that we are witnessing some good momentum this year. In 2020, the tractor sales amounted to 5 738 units, up by 9% from 2019, supported by the large summer grains and oilseeds harvest in 2019/20. Yet, 2020/21 was another excellent agricultural season and coincided with higher commodities prices boosting farmers’ finances and, subsequently, the tractor sales.

The planting period for the 2021/22 season for summer grains and oilseeds begins in October; as such, the sales for the next two months will be worth watching. As highlighted in our previous notes, we are somewhat pessimistic about the sales in the last quarter of the year. We fear that the rising input costs, such as fertilizers, herbicides and fuel, could add pressure on farmers’ finances and thus lead to a change in machinery-buying decisions. Also, the planting will be in full swing, and there would be little incentive to bring more new machinery. Still, the pace of sales in the first seven months of the year convinces us that, in aggregate, the annual sales for 2021 could still be larger than the previous year.